City Living Made Green and Easy

June 19, 2009

Inner Sunset Edwardian Condo

640 Judah is a 2 bedroom 1 bath condo located in the vibrant Inner Sunset neighborhood in San Francisco. I hope you will take a moment to stop by to see me this weekend on Sunday from 2 to 4 if you are in the area.

640 Judah is a 2 bedroom 1 bath condo located in the vibrant Inner Sunset neighborhood in San Francisco. I hope you will take a moment to stop by to see me this weekend on Sunday from 2 to 4 if you are in the area.At Home in the Heart of San Francisco

June 19, 2009

High-Style North Beach Condo

Sleek, modern and exciting are all words that I think of when I’m visiting this 2 bedroom 2 bath condo.

Sleek, modern and exciting are all words that I think of when I’m visiting this 2 bedroom 2 bath condo.

It has views of four San Francisco landmarks (Coit Tower, TA Pyramid, Sts. Peter Paul Cathedral and the B of A building) in an ultra-high style design building completed in January of 2007. Luxury finishes include a custom Corian soaking tub, radiant heated concrete floors, a gas fireplace, architect designed built-in cabinetry, Bosch cooktop, oven and dishwasher and a Miele range hood. The attention to detail in this building was so intense that even the doorframes are custom designed and fabricated. It is truly an unusual and special property.

520 Chestnut # 404 is priced at $899,000 and will be open Sunday from 2 to 4 p.m. For more photos, click here.

House of the Week: Think Pink!

June 13, 2009

Those of you who have known me a while will remember my obsession with a particular pink farm house on the eastern slope of Twin Peaks back in 2001. I spent several months scheming how I was going to get my hands on it and eventually wrote an offer to buy it for $875,000 without most of the adjacent and very valuable land. The owner eventually rejected my offer, and moved in herself, but I had the pleasure of imagining it could be mine for about 3 weeks and dreamed every night about what it would be like to wake up with the sun streaming in and views of Mt. Diablo and the bay from our bedroom.

Those of you who have known me a while will remember my obsession with a particular pink farm house on the eastern slope of Twin Peaks back in 2001. I spent several months scheming how I was going to get my hands on it and eventually wrote an offer to buy it for $875,000 without most of the adjacent and very valuable land. The owner eventually rejected my offer, and moved in herself, but I had the pleasure of imagining it could be mine for about 3 weeks and dreamed every night about what it would be like to wake up with the sun streaming in and views of Mt. Diablo and the bay from our bedroom.

I take it as a sign of personal growth that I can now present this fabulous property as my Home of the Week without too many pangs. It will be open this Sunday from 2 to 4 and I highly recommend you make viewing this wonderful estate property a part of your afternoon. For the MLS listing, click here.

Cine al Fresco

June 13, 2009

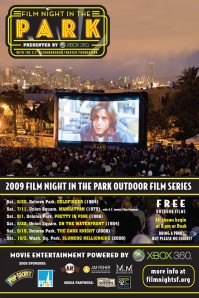

I am a huge fan of free public activies in general – just seeing all my fellow San Franciscans out enjoying our community gives me a thrill. And nothing is more fun than free movies in the park – a picnic dinner under the stars and snuggling those you love under a blanket while you watch a favorite movie. . . it’s like a modern urban campfire.

I am a huge fan of free public activies in general – just seeing all my fellow San Franciscans out enjoying our community gives me a thrill. And nothing is more fun than free movies in the park – a picnic dinner under the stars and snuggling those you love under a blanket while you watch a favorite movie. . . it’s like a modern urban campfire.

At least two organizations offer movies in San Francisco every summer: The San Francisco Neighborhood Theater Foundation (http://www.sfneighborhoodtheater.org/) and Dolores Park Move Night (http://www.DoloresParkMovie.org). Both are non-profits and could use your support. Last year there was a third organization, Alamo Square Movie Night that seems to be no longer functioning. Stefan and I attended several and think it’s perhaps because it was a tad too chilly for anyone but die-hards like us. )

You can generally count on my family planning to attend, so if you ever want to join us, just let me know. Here’s what I know about the schedules:

SF Neighborhood Theatuer Foundation Movies:

Saturday, 6/20, Dolores Park, GOLDFINGER (1964)

Saturday, 7/11, Union Square, MANHATTAN (1979)

Saturday, 8/1, Dolores Park, PRETTY IN PINK (1986)

Saturday, 8/22, Union Square, ON THE WATERFRONT (1954)

Saturday, 9/19, Dolores Park, THE DARK KNIGHT (2008)

Saturday, 10/3, Wash. Sq. Park, SLUMDOG MILLIONAIRE (2008)

Dolores Park Movie Night:

Thursday, July 9, at 8:30 P.M. – Annie Hall (1977)

Thursday, August 13, at 8:30 P.M. – TBD. They are open to suggestions. See the Web site.

Thursday, September 10, at 8:00 P.M. – TBD. They are open to suggestions. See the Web site.

Thursday, October 8, 7:00 P.M. – TBD. They are open to suggestions. See the Web site.

Growing Up in a Garden

June 13, 2009

If we’re connected on Facebook, you’ve already seen this picture of Elvis at our new community garden plot. Just two weeks later, we have arugula, radishes, basil, pumpkins, peas and various other things sprouting. We also, unfortunately, had a gopher siting. It’s been really fun so far! Although we have a yard, the placement of the fences does not make it ideal for cultivation of vegetables and we’ve also enjoyed getting to know some of our fellow gardeners. The cost? $25 a year. The land is owned by SF Park & Rec and the $25 goes into a community fund for things like garden hoses and other improvements.

If we’re connected on Facebook, you’ve already seen this picture of Elvis at our new community garden plot. Just two weeks later, we have arugula, radishes, basil, pumpkins, peas and various other things sprouting. We also, unfortunately, had a gopher siting. It’s been really fun so far! Although we have a yard, the placement of the fences does not make it ideal for cultivation of vegetables and we’ve also enjoyed getting to know some of our fellow gardeners. The cost? $25 a year. The land is owned by SF Park & Rec and the $25 goes into a community fund for things like garden hoses and other improvements.

These gardens are tucked away in out of the way unused spaces and offer an opportunity to experiment, grow your own food and make new friends. If you’d like to participate in a community garden, here’s a complete list of what’s out there in San Francisco. Waiting lists range from none to a few months or even several years. It’s worth checking out, as there’s no better way to eat local than to grow your own. To see the complete garden list, click here. If you belong to a garden, post on the blog and let me know what you think of yours!

Tax Credit Chart

June 13, 2009

| HOMEBUYER TAX CREDIT | FEDERAL | CALIFORNIA |

| Amount of Tax Credit | 10% of purchase price not to exceed $8,000. | 5% of purchase price, not to exceed $10,000. Maximum tax credit for all taxpayers is $100 million to be allocated on a first come, first served basis. |

| Principal Residence | Yes. Property purchased must be the taxpayer’s principal residence which is generally the home the taxpayer lives in most of the time (26 U.S.C. § 121). | Yes. Property purchased must be a qualified principal residence and eligible for the homeowner’s exemption from property taxes (Cal. Tax & Rev. Code § 218). |

| Type of Property | House, condominium, townhome, manufactured home, apartment cooperative, houseboat, house trailer, or other type of property located in the U.S. | Single-family residence, whether detached or attached, condominium, cooperative project unit, houseboat, manufactured home, or mobile home. |

| First-time Homebuyer | Yes. The buyer (and buyer’s spouse if any) must not have owned a principal residence during the three-year period before date of purchase. | No. The buyer need not be a first-time homebuyer. |

| Unoccupied Property | No. Property may have been previously occupied or not. | Yes. Property must have never been previously occupied as certified by the seller. |

| Minimum Occupancy Requirement | Must be the buyer’s principal residence for 36 months after purchase, otherwise credit must be repaid. | Must be the buyer’s principal residence for 2 years after purchase, otherwise credit must be repaid. |

| Income Restriction | Yes. Tax credit begins to phase out if modified adjusted gross income is over $75,000 (or $150,000 for joint filers). No tax credit at all if modified adjusted gross income is over $95,000 (or $170,000 for joint filers). | No. |

| Date of Purchase | January 1, 2009 to November 30, 2009, inclusive.(Note: A repayable $7,500 tax credit is available for purchases from April 9, 2008 to December 31, 2008.) | March 1, 2009 to February 28, 2010, unless $100 million funding runs out. |

| Refundable | Yes. Any amount of the tax credit not used to reduce the tax owed may be added to the taxpayer’s tax refund check. | No. |

| Repayment | The buyer need not repay the tax credit if the buyer owns and occupies the property for at least 36 months after the purchase. | The buyer need not repay the tax credit if the buyer owns and occupies the property for at least two years immediately following the purchase. |

| Multiple Buyers(not married to each other) | The $8,000 tax credit may be allocated between eligible taxpayers in any reasonable manner. | The $10,000 tax credit may be allocated between eligible taxpayers based on their percentage of ownership. |

| Maximum Credit for All Taxpayers | N/A | $100 million. |

| When to Claim | Full tax credit may be claimed on 2008 or 2009 tax returns. | 1/3 of total tax credit may be claimed each year for 3 successive years (e.g. $3,333 for 2009, $3,333 for 2010, and $3,333 for 2011). |

| Tax Agency | Internal Revenue Service (IRS). | Franchise Tax Board (FTB). |

| How to File | First-Time Homebuyer Credit(IRS Form 5405) to be filed with 2008 or 2009 tax returns | Specific procedure for claiming credit includes completing an Application for New Home Credit (FTB Form 3528-A). |

| When to File Form | Form 5405 must be filed with 2008 or 2009 tax returns. | FTB Form 3528-A must be faxed by escrow to the FTB within one week after close of escrow and filed with the buyer’s 2009 or 2010 tax returns. |

| Exceptions | Acquisitions by gift or inheritance, acquisitions from related persons as defined, and buyers who are nonresident aliens. | Credit allowed is not a business credit under Cal. Tax & Rev. Code § 17039.2. |

| Legal Authority | 26 U.S.C. section 36. | Cal. Rev. & Tax Code section 17059 (as amended by Senate Bill 15). |

| Date of Enactment | February 17, 2009. | February 20, 2009. |

| More Information | IRS website at http://www.irs.gov/newsroom/article/0,,id=204671,00.html. | FTB website at http://www.ftb.ca.gov/individuals/New_Home_Credit.shtml which includes a tally of the $100 million original funding that is still available. |

Copyright ã 2009 CALIFORNIA ASSOCIATION OF REALTORS â (C.A.R.). Permission is granted to C.A.R. members only to reprint and use this material for non-commercial purposes provided credit is given to the C.A.R. Legal Department. Other reproduction or use is strictly prohibited without the express written permission of the C.A.R. Legal Department. All rights reserved.

The information contained herein is believed accurate as of April 13, 2009. It is intended to provide general answers to general questions and is not intended as a substitute for individual legal advice. Advice in specific situations may differ depending upon a wide variety of factors. Therefore, readers with specific legal questions should seek the advice of an attorney.

HOMEBUYER TAX CREDIT CHART

Market Update – Signs of Life (at last)!

June 13, 2009

In recent weeks, the number of listings accepting offers has increased substantially, while the number of price reductions and expired and withdrawn listings – though still high by historical standards – has decreased significantly. Months-supply-of-inventory (MSI), an indicator of seller supply and buyer demand, has also declined. (The higher the MSI, the greater the buyer advantage.) Whether this will prove to be the beginning of a durable resurgence for SF real estate or simply a springtime bounce, it is too soon to tell.

The area where most house sales are now occurring is Realtor District 10 (Bayview-Portola-Excelsior). Then comes District 2 (Sunset-Parkside), District 5 (Noe-Castro-Haight) and Bernal Heights. District 10, with the greatest number of foreclosure sales, has been hardest hit by price declines, and has roughly as many sales as Districts 2 and 5 combined – so it has had a massive impact on overall median price in SF. (Which is one reason why the overall city median home price is virtually worthless as an indicator of changes in market values.)

Most condo sales are occurring in South Beach-SOMA, then District 5 (Noe-Castro-Haight), and then District 7 (Pacific Heights-Cow Hollow-Marina). These numbers don’t include new development sales unreported to MLS – which would greatly increase the South Beach-SOMA sales numbers. The new developments are doing everything they can to move inventory right now.

Foreclosure Sales Update

Since mid-October 2008, 17% of house sales and 6% of condo sales in San Francisco have been REO (bank-owned) homes. The median sales price of an REO house during this period has been relatively stable at about $500,000; the median sales price for an REO condo has been $432,000. 78% of REO house sales have occurred in the less affluent south/southeast part of the city, stretching from Bayview to Oceanview. 85% of REO condo sales have been in the neighborhoods stretching south from SOMA along the east side of the city down to Bayview and across to Oceanview. The greater part of the city – northern, central and western neighborhoods – continues to be relatively unaffected by foreclosure sales.

Below, median sales prices are calculated for 2-bedroom condos, 3-bedroom houses and 2-bedroom TICs in a number of SF neighborhoods over a variety of periods beginning with 1995 — when the last, great Sellers’ market began — and ending with the six months following the financial market meltdown in September 2008. (Its effect began to show up in mid-October sales.) Median price is a relatively crude statistical generality – especially in SF with its huge variety in property type, size, condition, curb appeal and architectural style – but it can be useful in assessing macro trends in the market. However, remember: for a specific home, only a specific market analysis is truly pertinent.

Since October 15th, year over year, the number of sales has dropped 20% for houses, 35% for condos, 53% for TICs and 46% for 2-4 unit buildings. But that masks significant changes in buying trends: the number of houses sold below $1,000,000 actually increased 4%, while sales of more expensive houses plunged over 50%. People are generally buying smaller, less expensive homes, and then, only those that stand out as excellent values. Less appealing homes – which still sold in earlier years (virtually everything sold during the boom years) – are not getting reflected in the current figures.

Some of the more affluent neighborhoods had too few sales to be statistically meaningful. For example, in the last 6 months, all of Pacific & Presidio Heights, Cow Hollow and the Marina had only 19 house sales, of all sizes and prices. St. Francis Wood had only 6 and Sea Cliff only 4. Roughly 50 – 70% of buyers of upper-end homes – who would typically be considered “willing and able” – can no longer get better financing rates without very large down payments. When that changes, we’ll be better able to assess values in that market segment. In the meantime, it is dominated by buyers with lots of cash.

Depending on your email system, you may have to give permission to download the following charts.

Further analyses of percentage changes in median and average prices, and dollars per square foot can be found here:

Percentage Declines Analysis

Rent v. Buy: What’s Better for You Right Now?

June 13, 2009

As is clear from the above, the long term value of buying versus renting is easy to show. But what about the short term? Well, due to price declines, tax benefits and exceedingly low interest rates, the Rent versus Buy equation – which went badly out of whack during the runaway Sellers’ market – has been coming much more into balance. Here is a sample calculation comparing paying $2600 rent with purchasing a $650,000 home. Since any calculation depends on one’s assumptions regarding inflation, appreciation, interest rates, down payment, term of ownership, and so forth, please feel free to use the calculator referenced to perform your own calculation.

Sample Rent vs. Buy Calculation

RSS feed for this blog

RSS feed for this blog